Introduction

Our expertise in asset recovery has led to successful cases ranging from 20,000 to millions of USD. We collaborate with prominent figures in Thailand to ensure successful asset recovery. Trust Mike Green Private Investigation for effective and reliable debt collection and asset recovery services.

Debt collection details

- Locate the Target: Physically locate the target to start the recovery process.

- Asset Check: Identify all assets registered to the target, including bank statements, to uncover hidden funds and spending patterns.

- Surveillance: Monitor the target’s behavior to gather information and strategize before engagement.

- Engagement: Engage with the target, possibly involving law enforcement or the anti-money laundering office, to ensure legal compliance and successful recovery.

- Retrieval: Coordinate with financial institutions, legal entities, and law enforcement to securely and legally reclaim assets. Our team manages the entire process, ensuring assets are transferred back to the client efficiently and professionally, minimizing risks and delays.

When to expect the results

Results for debt collection and asset recovery are typically delivered within 2 weeks to 2 months, depending on the complexity of the case. Each case is unique, and timelines can vary accordingly.

- 2 Weeks – 2 Months

- Ease of Access

- Quality Assurance

- Customer Support

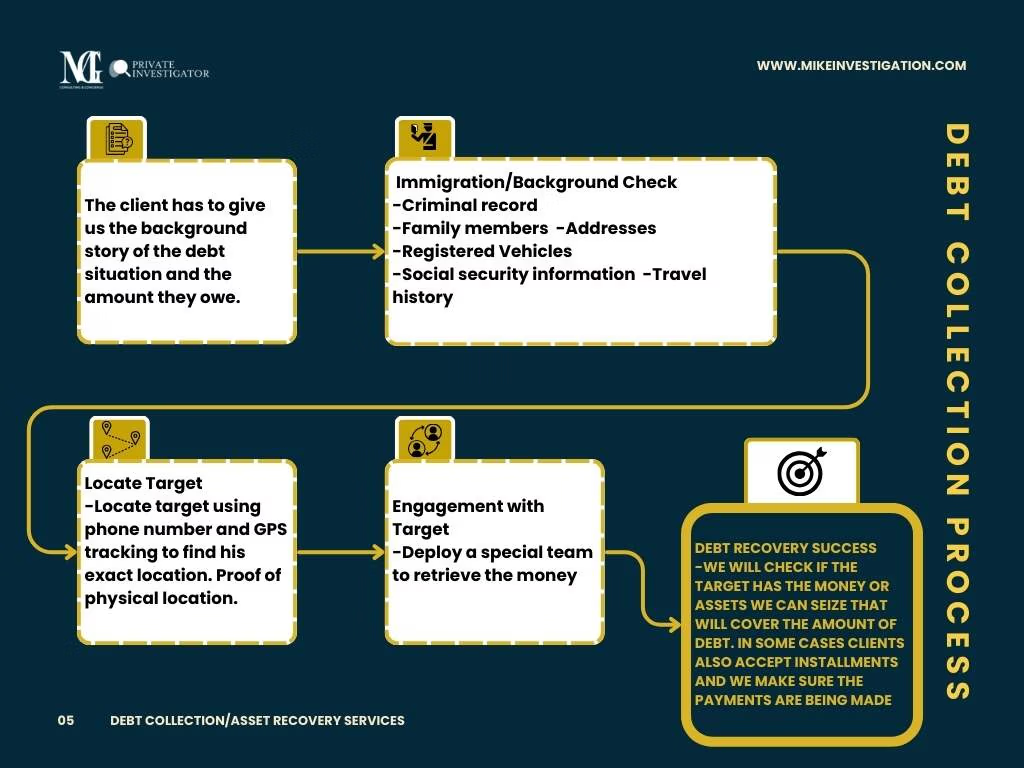

Debt collection process

- Background Information: The client has to provide the background story of the debt situation and the amount they owe.

- Immigration/Background Check: Criminal record, family members, addresses, registered vehicles, social security information, travel history.

- Locate Target: Use phone number and GPS tracking to find the exact location. Proof of physical location.

- Engagement with Target: Deploy a special team to retrieve the money.

- Debt Recovery Success: Verify if the target has the money or assets that can be seized to cover the debt amount. In some cases, clients accept installments, and we ensure the payments are being made.

Pricing and payment options

Pricing is determined on a case-by-case basis, depending on the information provided by the client and the complexity of the case. For an exact quotation, please contact us.

Payment Options:

- Bank Transfer

- Western Union

- Cryptocurrency

- Credit Card

according to the updated currency rate

Our Debt Collection Process – Mike Investigation

At Mike Investigation, we offer a streamlined and effective debt collection process designed to recover outstanding debts while maintaining the highest levels of professionalism and respect for the legal frameworks in Thailand. Our debt collection process is thorough, transparent, and flexible, ensuring that we can adapt to any situation, whether local or international.

1. Comprehensive Assessment of Your Case

Before initiating any debt collection process, we perform a thorough review of your case to understand the specifics of the debt, the debtor’s profile, and any prior communications or actions taken. This allows us to create a tailored strategy for debt recovery.

- Debtor Identification: We verify the debtor’s identity and contact details to ensure our collection efforts are directed efficiently.

- Debt Evaluation: We assess the amount, terms, and any contractual agreements related to the debt to ensure that all legal and financial aspects are clearly defined.

- Risk Analysis: Based on the debtor’s history and financial stability, we evaluate the likelihood of successful recovery and the best approach to take.

2. Initiating the Debt Collection Process

Once we have reviewed the situation, we initiate the debt collection process by reaching out to the debtor through various channels, depending on the situation. Our approach is diplomatic but firm, ensuring that the debtor understands the seriousness of the matter while maintaining the highest level of professionalism.

- Phone Calls: We make initial contact with the debtor via phone to discuss the debt and request repayment. We often find that many debts can be resolved quickly through direct conversation.

- Written Communication: For formal requests, we send written notices outlining the debt, the consequences of non-payment, and the urgency of resolving the matter.

- In-Person Visits: In certain cases, we may arrange face-to-face meetings to address the issue more personally, especially when the debt is significant.

3. Negotiation and Settlement

In cases where the debtor acknowledges the debt but is unable to pay in full, we work with both parties to negotiate a repayment plan that is fair and manageable. Our skilled negotiators aim to reach a settlement that works for both sides, reducing the need for legal action.

- Payment Plans: We can structure affordable payment plans that allow the debtor to settle the debt in installments.

- Debt Reduction Negotiation: In some cases, we can negotiate a lower settlement amount, depending on the debtor’s financial situation and willingness to resolve the matter.

4. Legal Action and Court Involvement

If negotiations fail and the debtor refuses to repay, we are prepared to take legal action to recover the debt. This includes filing a lawsuit and pursuing judgment in a Thai court. We guide you through every step of the legal process to ensure compliance with local regulations.

- Filing a Lawsuit: If the debtor fails to respond to our efforts, we can file a claim in the Thai courts to demand payment.

- Court Orders: We work with Thai law enforcement to enforce any court orders and judgments in your favor.

5. Enforcement and Asset Recovery

Once a court judgment is in place, our team works diligently to enforce it. We utilize various methods to recover the debt, including garnishing wages, seizing property, or liquidating assets. Our goal is to ensure the debt is paid in full.

- Wage Garnishment: We can take legal steps to have a portion of the debtor’s salary directed to debt repayment.

- Asset Seizure: If the debtor owns assets, we can initiate the legal process to seize and sell those assets to recover the outstanding debt.

6. International Debt Collection

For clients facing cross-border debt recovery issues, Mike Investigation offers international debt collection services. We have the experience and network to recover debts from individuals or companies located outside of Thailand. Our international debt collection strategies ensure a smooth process for both local and global clients.

- Global Network: Through partnerships with international legal and investigative experts, we extend our reach beyond Thai borders to track down and recover outstanding debts from foreign debtors.

- Cross-Border Legal Compliance: We ensure that all international debt collection efforts comply with both Thai law and the laws of the debtor’s country.

7. Continuous Communication and Updates

Throughout the entire debt collection process, Mike Investigation keeps you informed every step of the way. We provide regular updates on the progress of the recovery efforts, ensuring transparency and peace of mind.

- Real-Time Tracking: Clients can track the progress of their case through our secure online portal.

- Timely Reports: We provide comprehensive, detailed reports about the status of negotiations, legal action, or asset recovery efforts.

Conclusion: Trust Mike Investigation for Professional Debt Recovery in Thailand

Our commitment is to recover your debts swiftly and professionally, ensuring that your business or personal financial well-being is protected. Whether you need to recover a debt locally or internationally, Mike Investigation has the expertise to handle your case with the utmost care and confidentiality.

Contact Mike Investigation today to discuss your debt collection needs and let our experts assist you in recovering outstanding debts.